3 Reasons We Created the Willing Wisdom Index™

Introducing the WILLING WISDOM INDEX™ for Advisors

A conversation-starting, relationship-building,client-engagement tool like no other.

3 Reasons we created the Willing Wisdom Index™

Reason #1

The state of estate planning is appalling, but an opportunity of epic proportions for the best and brightest advisors.

137 million North American adults do not have a will. This is not good, especially when you consider that we are now leaving more wealth than ever before – $2 billion per day in the US and $205 million per day in Canada. It’s not cost that’s preventing people from moving forward with their estate plans – wills have been a race to the bottom in terms of quality and price. You can now get a will kit for as little as $19.95. It should come as no surprise that estate litigation remains one of the fastest growing areas of the law. Advisors who start conversations about estate planning will quickly differentiate themselves from their competitors.

Reason #2

The industry needs a tool to help extraordinary advisors change lives and earn more money …way more.

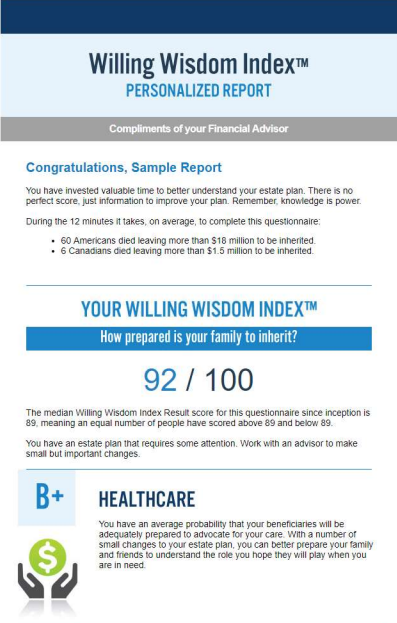

It’s clear that financial advisors are the key to inspiring family conversations about aging, late-in-life care and well-considered, well-communicated estate plans. We all know there are exceptional advisors who deliver comprehensive estate planning services and others who just say they do. So with the help of one of the world’s leading software design firms, we created a tool that makes it easy for clients to spot the difference. The Willing Wisdom Index™ was created as a wedge tool to help advisors begin conversations with HNW individuals over the age of 50. The conversations focus on estate plans and the gaps revealed by the Willing Wisdom Index.™ Most of all, the Willing Wisdom Index™ was created as a predictive tool that evokes curiosity, interest and conversation around a subject that many advisors and clients find difficult to discuss. Advisors who use the Willing Wisdom Index™ have virtually no competition.

Reason #3

The best advisors need tools to begin new conversations and reignite relationships that have stalled — conversations that many advisors simply avoid.

Adding real value to client relationships means educating clients in areas of their financial life that are emotionally complex and technically confusing. And there is no area of personal finance more complex, confusing and neglected than estate planning (the 137 million people without wills are living proof). In an era of automated investing, estate planning remains the single most overlooked opportunity for advisors to add value to client relationships. So, we’ve made it easier and more engaging.

“Whether starting a new conversation or following up on a stalled relationship, the Willing Wisdom Index™ is a low-cost engagement tool that reveals estate planning gaps for clients and prospects in as little as 9 minutes.”

We’re offering the Willing Wisdom Index™ exclusively to advisors on a subscription basis for less than $21/month. Subscribers receive marketing support, including email templates and videos to help distribute access codes and to on-board HNW prospects as clients.

Our research shows that HNW individuals over age 50 with more than $1 million in investible assets are receiving some of the lowest Willing Wisdom Index™ results – on average, 45 out of 100. These HNW clients are professionals and business owners who are unaccustomed to receiving failing grades. They are quick to ask, “What estate planning support is my advisor offering me?”

We call this game, set, wedge – the advisor who shared the Willing Wisdom Index™ resource is through the door and starting a powerful conversation.

“HNW individuals are deeply curious to discover how prepared their family is to inherit.” And that’s how we are going to get 137 million American and Canadian adults thinking, talking and writing their wills: by giving the best and brightest advisors a new tool to start hundreds of conversations with HNW individuals who either don’t have an advisor or have one who is neglecting estate planning.

The Willing Wisdom Index™ helps the most talented advisors achieve financial success by spending less time and money marketing and more time helping HNW clients actually succeed with their family wealth transfer plans. And that’s exactly what a game changing client engagement tool should do.

Learn more by watching this short video:

To test drive the Willing Wisdom Index™ – and to see how prepared your own family is to inherit – simply email sales@WillingWisdom.com and type “free access code please” in the subject line.

Click here to review subscription levels and to purchase your subscription today.